How To Get Seller To Pay For Repairs On A Forecloseure

Advance Payment Meaning

Advance Payment is a payment that is made by a buyer to the seller before the actual scheduled fourth dimension of receiving the goods and services. It protects the seller from the run a risk of non-payment that could happen in the future. Additionally, it tin can help the seller financially in the production or procurement of the goods or rendering of services. It appears on the avails side of the residual sheet every bit a prepaid expense for the buyer. Such advances are usually required when a heir-apparent had defaulted payments in the past, and then it protects the sellers from such unforeseen events.

How to Account for Advance Payment?

For Buyer: A buyer making an advance to the seller shall record the transaction past debiting the seller account and crediting the cash or bank account. Nosotros evidence the debit residuum of the seller account as a current asset Electric current assets refer to those brusque-term assets which tin be efficiently utilized for business operations, sold for firsthand cash or liquidated within a yr. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc. read more than in the books of accounts of the buyer until the goods or services are received, and the invoice issued.

For Seller: To account for an accelerate, the seller needs to debit Debit represents either an increase in a company'southward expenses or a turn down in its acquirement. read more than cash or bank account and credit the buyer account with the aforementioned amount. The credit balance of the buyer business relationship increases current liabilities Electric current Liabilities are the payables which are likely to settled within twelve months of reporting. They're normally salaries payable, expense payable, short term loans etc. read more . Once the customer receives the required goods or services, the seller or institution has to send an invoice to the customer. The invoice contains the total amount owed after subtracting it. Once completing all this procedure, the institution or seller has to record the post-obit transactions in the books of accounts:

- Acquirement is credited

- Accounts receivable is debited

- The customer or buyer account is debited.

You lot are free to use this image on your website, templates etc, Delight provide united states of america with an attribution link Article Link to be Hyperlinked

For eg:

Source: Accelerate Payment (wallstreetmojo.com)

Examples

'Prepaid cellphones' is an instance of an advance payment. The customer has to make payment for the prepaid cellphone in accelerate to relish the benefit of it for a month. The service provider provides service for 1 month only when information technology receives the prepayments. Likewise, 'Prepaid rent' or 'utilities' are other such examples.

The other of import case is the U.S 'taxpayers' receiving accelerate payments from the premium tax credit (PTC). Information technology helps the citizens in household activities and for other purposes. The due money of the taxpayer is paid to the insurance visitor in advance.

Accelerate Payment in Businesses

Companies that are involved in the manufacturing process need payment in advance as it will show commitment from the heir-apparent'southward side that they are willing to purchase and will buy it in the future. It protects the business from unforeseen losses. Information technology besides shows the trust of the buyer for the seller as many of these advance payments are nonrefundable.

It provides capital to the seller for the structure of the required goods or services. And it saves the seller from using their wealth or taking a loan for the making of the product.

Advance Payment Guarantee

Prepayments Prepayment refers to paying off an expense or debt obligation before the due appointment. Frequently, companies make accelerate payments for expenses every bit well every bit goods and services to shed their fiscal brunt. Advance payments also act as a tool to achieve monetary benefits. Examples of prepayment include loan repayment before the due engagement, prepaid bills, rent, bacon, insurance premium, credit card neb, income tax, sales taxation, line of credit, etc. read more than protect the sellers from unforeseen losses, but it is a bad deal for buyers as information technology poses a chance for them. If the seller is unable to deliver the goods on fourth dimension, buyers could be in a difficult position. For this purpose, an advance payment guarantee serves buyers as insurance by protecting them from such a situation. According to this, if a seller somehow can't deliver the goods on time, then the institution or the seller has to refund all the prepayment to buyers. Buyers tin consider the deal as void if the seller is unable to deliver.

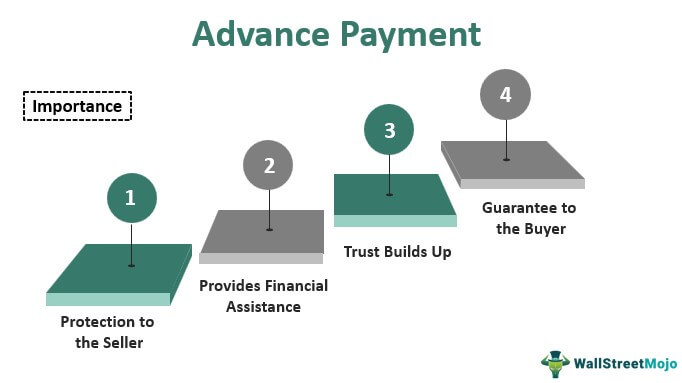

Importance

- Protection to the Seller: Advance payment protects the seller from the heir-apparent with a bad credit score and nonpayment.

- Provides Financial Assistance: Provides financial help to the seller in making the goods.

- Trust Builds Up: Trust is the most disquisitional and difficult matter in the business to earn, and when a buyer makes a prepayment fifty-fifty for the non-refundable deals the trust between the heir-apparent and the seller grows.

- Guarantee to the Buyer: The guarantee assures the buyer that if the seller is unable to stay on its words, and so the seller will refund the prepayments into the account of the customer.

Risks with Accelerate Payment

Ane of the well-nigh pregnant risks with the advance payment is for customers. They may get into trouble if the seller fails to fulfil the deal. It might be challenging for buyers to become their money dorsum once the company they had invested in is declared to be broke. That'due south the main reason most of the buyers prefer to make payment but when they become what they wanted.

Recommended Articles

This article has been a guide to Advance Payment and its meaning. Here we hash out its bookkeeping forth with examples for accelerate payment forth with its example, importance and special considerations. You may acquire more about financing from the following articles –

- Prepayment Penalty

- Advance Refunding

- Notes Receivable

- Types of Credit

Source: https://www.wallstreetmojo.com/advance-payment/

Posted by: palmersquam1970.blogspot.com

0 Response to "How To Get Seller To Pay For Repairs On A Forecloseure"

Post a Comment